How to analyze tire sell-out prices in 5 steps?

- What are the sell-out price dynamics in my market?

- What is my price positioning in relation to my competitors?

- On which product panel? In which segment?

- In which geographical area? On which channel?

- Is my profit margin preserved? etc.

Define the scope for online price collection

What is quality consumer price data?

- This first criterion is to precisely answer business questions you have defined beforehand. As such, when analyzing this data, the extraction of findings will be directly related to the previously mentioned issues.

- The second is the notion of confidence: origin of data (traceability), repeatability in the collection process and independence of the supplier in relation to the market. Indeed, a supplier cannot sell its products in the target market and produce its own data.

What level of accuracy is required to provide a consistent and detailed price analysis?

The level of data accuracy has a significant impact on the results of an analysis. Indeed, the average difference in price for a tire, with or without a manufacturer’s marking (e.g. AO marking for Audi), for a same size, can vary by several percentage points. The inability to distinguish them will distort the analysis of the average price for a specific size.

When to collect data?

The lifespan of price data is inherently very short. Therefore, its freshness is a criterion of crucial importance. In e-commerce, the frequency of re-pricing is very high, often day-to-day in the tire industry, and sometimes on an intraday basis in other industries.

The collection frequency is therefore of utmost importance to obtain the most accurate analysis possible: an average price per week will be more accurate if prices are collected daily.

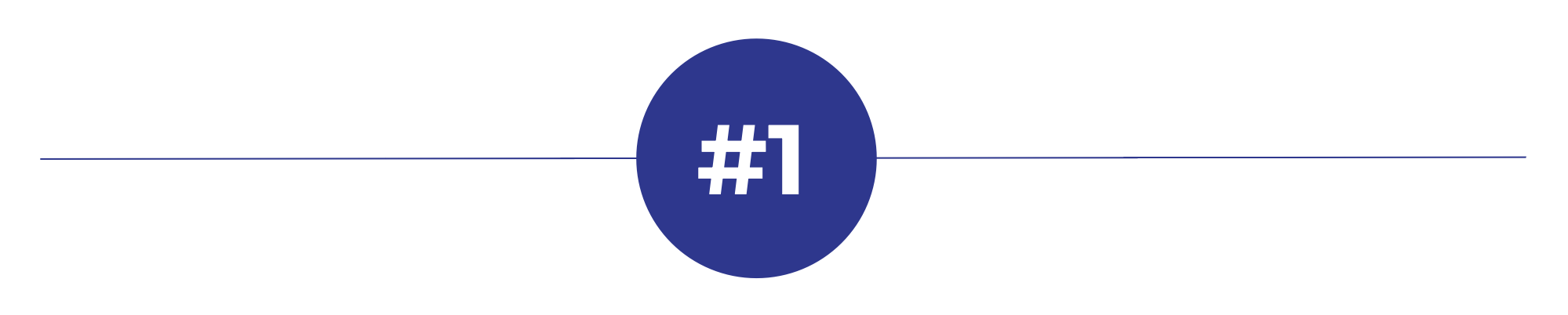

What parameters are involved in the collection of online price data?

Scope

- Geographical: what country, region, states?

- Commercial websites: number, location, etc.

- Products: What brands, what product ranges?

- What segment: Touring, Truck, Motorcycle, etc.

- Sizes: 16, 17 or 18 inches

Depth

- Complete size: 205-55-R16-91V

- Technical markings: Runflat, Manufacturer Marking (OE), Rim protection, etc.

Freshness

- Collection frequency: daily, weekly, etc.

How to collect data in an automated, industrialized and controlled way?

The collection of online consumer price data requires the use of tools which “visit” targeted commercial websites to collect the information needed, without disrupting them (ethical collection).

These tools must be smart and efficient since an e-commerce website is bound to change regularly: new design, new layout, new URL, etc.

These changes have a direct impact on data collection tools: website change = loss of data collection.

In order to keep these tools up to date, you need a team that monitors each website on a daily basis to ensure the operational capability of the system, 24 hours a day, 7 days a week.

Clean, match and unify data

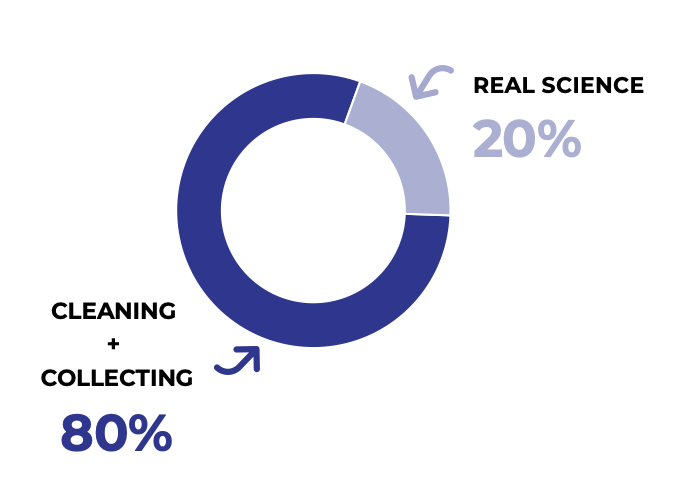

Now is the time that ‘Data’ specialist expertise comes into play.

The description of a tire sold online is one of the elements that can vary significantly from one e-commerce website to another.

The list of attributes which constitute the description of a tire and which can vary are as follows:

- The brand

- The product name, with correct punctuation

- The technical markings (runflat, OE Marking)

- The tire manufacturer code

To be able to attach the prices collected to the right tire, it is necessary to “understand” and decipher the key elements displayed which allow this product to be identified in order to compare them with a ‘specific’ reference base of existing tires (current or in the past) and validated (with an official source attesting it). This is the data unification step.

This referent database is the cornerstone of an efficient matching system to deliver data with an unparalleled level of quality.

The comparison of data collected with this referent database checks that the information found online for this tire exists: does this tire come from this brand? with its technical attributes? etc.

This allows data collected online to be systematically and automatically categorized:

- Unknown product: is it new?

- Known product: attachment of the collected price, its source and the collection date

- “False” product: the combination of information is not possible – the product does not exist

Finally, the most outrageous prices are also filtered (e.g.: a touring tire sold for less than $20 is unlikely to be real)

The combination of a highly qualitative tire database, matching technologies, Machine Learning algorithms and product marketing expertise provides quality data with a high level of completeness.

This will allow you to focus on your business (the analysis) and gain in efficiency. Indeed, analysts and Data Scientists spend between 50 and 80% of their time cleaning data before they can start handling it!

Enhance data through tire market knowledge

Enhancement data:

- Tire Manufacturer Segment (Third party): Premium (1), Medium (2), Budget (3)

- Tire segment: Car performance, LT All-Terrain, CUV standard, etc.

- Season: Summer, Winter, AllSeason

- OE Marking: Audi, Mercedes, BMW, Tesla

- Technologies: Runflat, Seal, Noise-Dampening, etc.

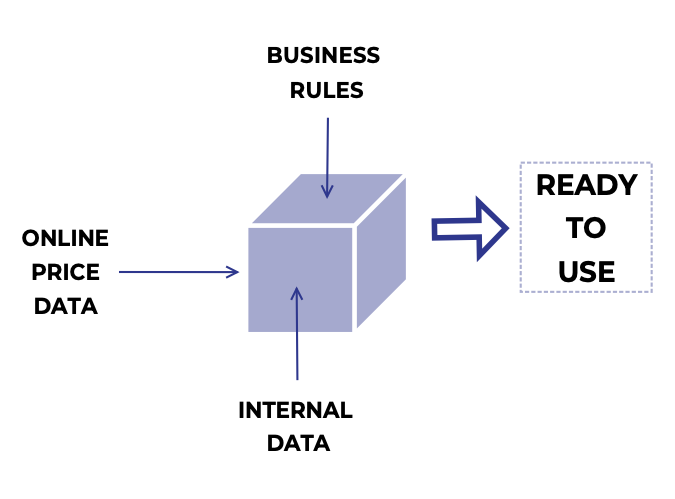

Preparation and generation of the final data cube

The preparation step converts unified and enhanced data into a set of data (cube) that integrates your business rules, your internal data but also your vision of the market and your segmentation. Indeed, data on competitors’ prices is a key element in understanding the market but internal data is just as important.

Examples of business rules:

- Segmentation of tire manufacturers and trade organizations

- Aggregation of data by channel

- Aggregation of products by use

- Calculations on an identical scope of sizes

- Product clustering/segmentation

- Market Volume weighing

Examples of Internal data:

- Sales volumes

- Sell-in price data

- Profit margin

- OE fitment (Tire is original equipment on vehicle brands and models)

This is the step where the accuracy and consistency in the collection of online data is of particular importance. Indeed, to make sense of these 2 data sets, the granularity of online data must be at the same level. As such, these 2 data sources will be matched at the same level in order to compare the same elements.

This is the last step before starting to ‘consume’ data in business tools.

Data analysis and extraction of findings

- What is their background? Technical, Non-technical.

- What is their level of maturity / knowledge with respect to the data? Beginner, expert, etc.

- What is their function? Price Analyst, Data Scientist, Statistician, etc.

- What are their objectives? Study, monitor, decide, etc.

- Who are their studies for? Management, Sales, Marketing, etc.

- What is the frequency of use? Daily, weekly, monthly.

- A Data Science tool to handle and create views and data cubes, create scenarios and simulate them, compare scenarios, etc.

- A Business Intelligence tool which will perform “data discovery” and extract findings: advanced filtering, data mining, construction of indicators, etc.

- A Data Visualisation or dashboarding tool to share findings, make decisions quickly or manage an activity on a daily basis.

Why you should trust us with this methodology for analyzing sell-out prices in the tire market?

Lizeo Group supports its customers in their data-driven digital transformation and has been collecting tire price data online on a daily basis for more than 10 years on over 1000 e-commerce sites worldwide.

This represents approximately 11.5 Million price lines per day, in all currencies, which are cleaned, matched, enriched and ready to use.