Get the full picture of your market by collecting price data at every point

To maintain your competitive edge in your market, you need to monitor and keep track of your competitors’ price behavior in order to adjust your pricing strategy. Price monitoring on a global market remains extremely difficult due to the abundance of available online data. As decisions and pricing strategies are based on data analysis, the quality and accuracy of collected price data are critical.

Your Challenges

Collecting competitor price data and creating a trustworthy database raises many challenges. As sources are available both online and offline with discrepancies in product descriptions, businesses face major challenges in:

Automation of the collection of price data with accuracy and quality

Controlling quality and consistency of data

Ability to match collected price data with the correct description

Lizeo®.price data

How does it work?

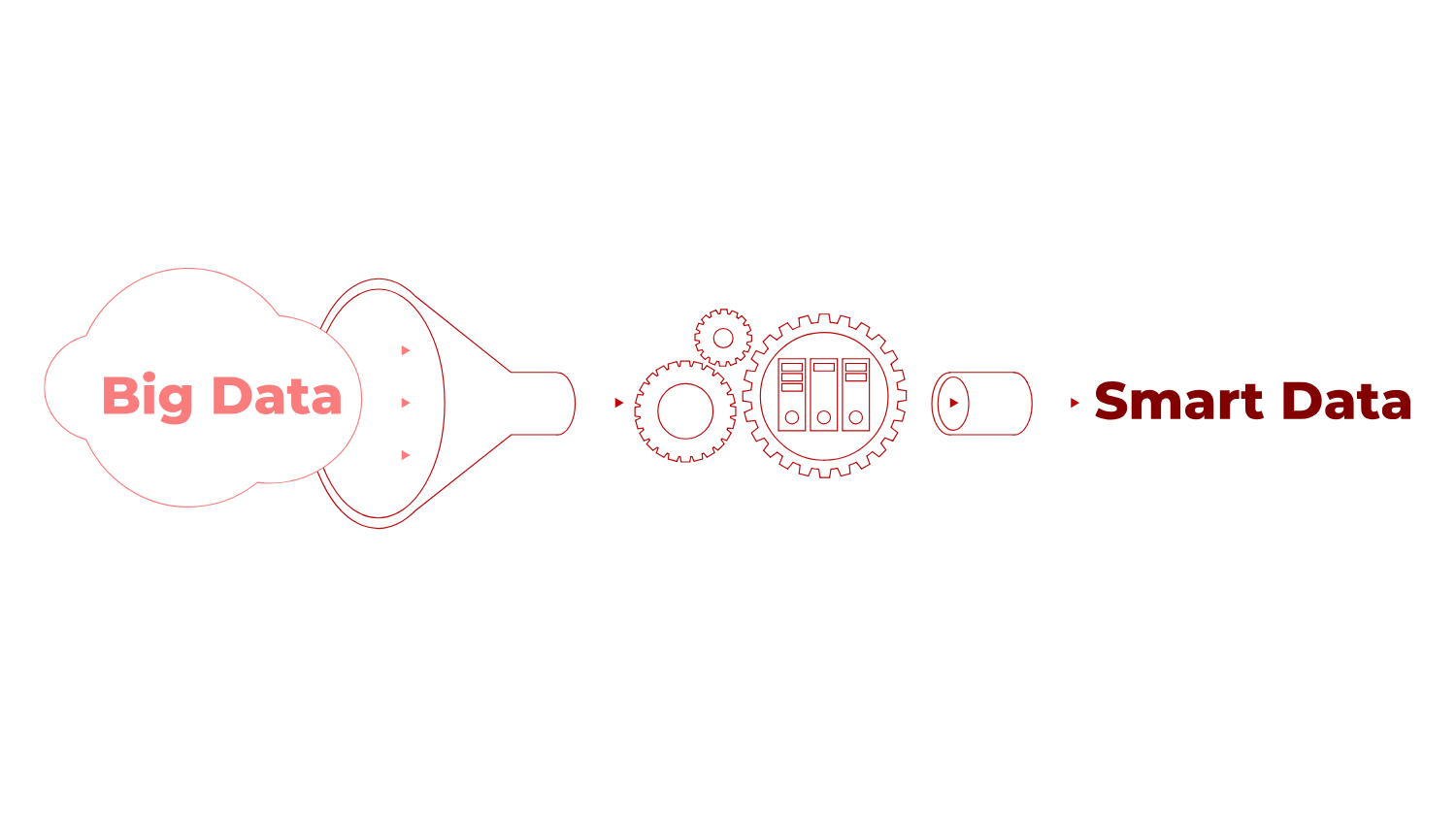

1. Define your objectives and strategy related to the use of competitor price data

2. Select the scope of products, websites, marketplaces, and countries you would like to monitor

3. Define your price data flow content (depth of product information, aggregation, price pre-calculation, corridors, etc.) that will match your usage

4. After collecting, parsing, matching and cleaning data, we deliver a meaningful dataset, consistent with your needs and usage at a predefined frequency and format

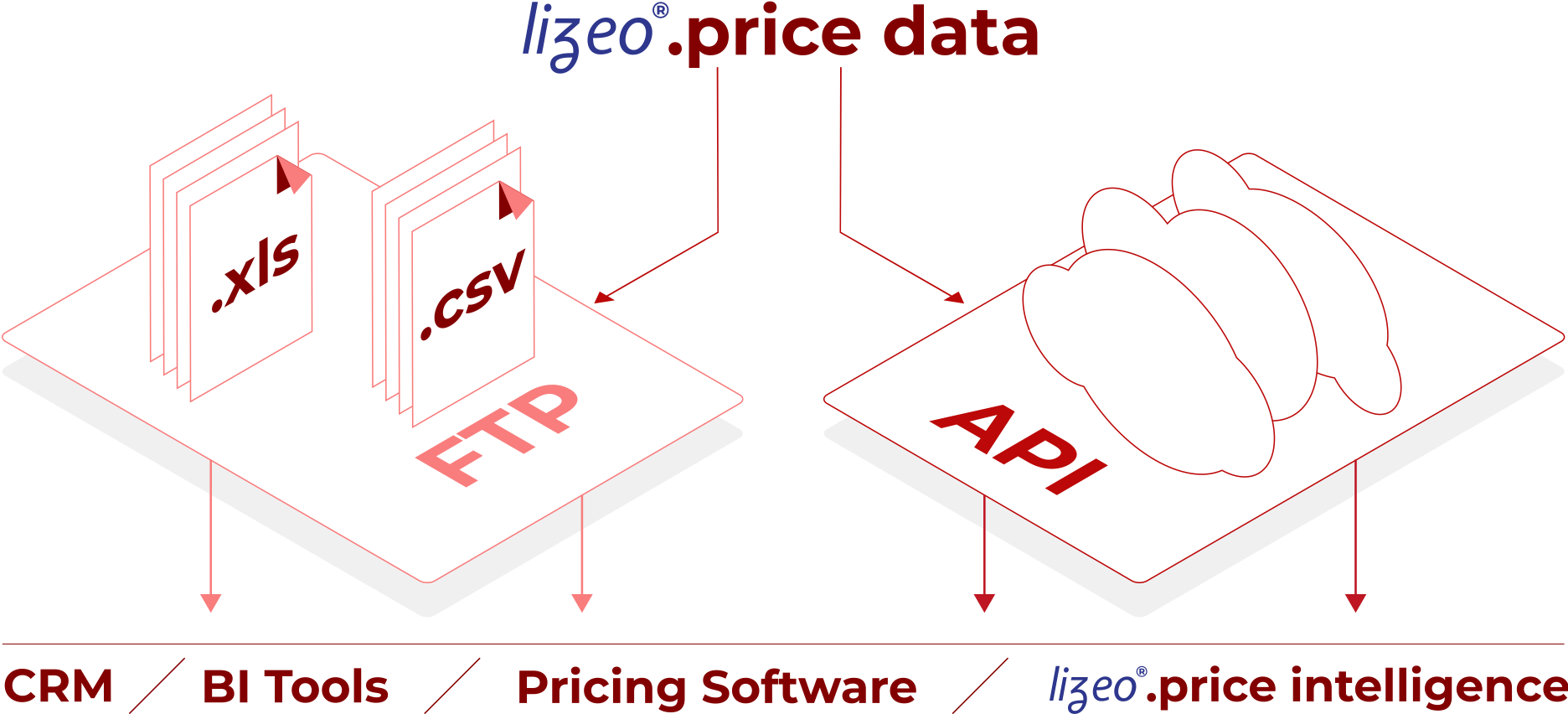

Data Delivery

- Transfer through Application Programming Interface (API), FTP (File Transfer Protocol) or flat files (.xls, .cvs).

- Receive your data weekly, monthly or at any desired frequency.

- Preconfigured data sets: daily prices aggregated in a weekly vision, with pre calculations (minimum, maximum, average, median prices)…

The Benefits

Save time on your data collecting process and focus on your pricing strategy

Base your decisions on high quality, relevant and ready to use data

Get data delivered with your own market segmentation and pre calculations

Who is it for?

Pricing Teams

Product & Marketing Teams

Top Management

Use Cases

[WEBINAR] Pricing Strategies in a Shifting Automotive Landscape

In today’s fast-paced automotive market, staying competitive means embracing dynamic pricing strategies. With online retailers and direct-to-consumer brands disrupting traditional methods, it’s crucial for distributors to adapt and innovate. In a recent webinar, industry experts Pierre Hébrard from Pricemoov and Philippe Carval from Lizeo shared game-changing insights on how to leverage real-time data and automated pricing tools to protect your margins and thrive.

The rise of EVs (Electric Vehicles): what are the consequences for the tyre industry? – US

The rise of electric vehicles is transforming the tire industry. As EVs grew from 6.6% of new car models in Europe in 2020 to 31.8% in 2024, tire manufacturers have had to adapt to new demands: heavier vehicles, instant torque, regenerative braking, and reduced noise levels. The result? The EV tire offering has exploded, with over 1,400 dedicated models available online in 2024 compared to just a few dozen in 2020.

From millions of data points to actionable insights: Lizeo’s AI-powered approach

Lizeo transforms massive amounts of data into actionable insights using AI-powered text analysis. With expertise in sentiment analysis, topic extraction, and brand detection, Lizeo helps businesses stay ahead in their market.